Rolling out some new Blogs

Digital And Diversity: How Tech Can Help Wealth Managers Expand Their Client Pool

The wealth management industry is looking to diversify. No, not in terms of their portfolio of investments. Rather, they are seeking to expand beyond the current pool of customers they typically provide services to.

That’s according to the Deloitte-sponsored ThoughtLab report Building a Future-Ready Investment Firm, which surveyed 2,000 investors and 250 investment providers about the future of wealth management. So what do these new customers look like? There’s a range of options—from younger generations to emerging markets. But one thing is clear: technology will play a major role in accessing these new customers, understanding their needs, and tailoring offerings accordingly.

The changing face of investors

According to the survey, in the next three years, 63% of investment and wealth management firms plan to expand in their main client segment, while only 32% plan to deepen their share of wallet with existing clients. That means wealth managers are actively identifying new niches of customers to explore, with the following categories standing out:

- Younger generations: It is estimated that more than $15 trillion in wealth will transfer from older generations to younger ones by 2030. While this new pool of customers seems a natural target for wealth managers, they’ll need to first understand and adapt to the unique investing behaviors of a younger crowd.

- “Mass market”: While many firms are looking to expand up-market to high-net worth customers, a few forward-looking segments are seeking out customers with less wealth or the “mass market.” This includes robo-advisors—automated financial advisors—online platforms, and the wealth advisory divisions of large universal and investment banks. For these businesses, the share seeking to go down-market is twice the average for wealth management businesses overall.

- Cross-border: Global wealth is projected to increase by 38% by 2027, thanks partly to the rise of emerging-market investors. As such, more and more investment firms are looking to find customers outside of their domestic markets. Nearly 40% are planning to expand across borders over the next three years.

- Women: If women invested at the same rate as men there would be an extra US$3.22 trillion of assetsunder management. But only 30% of firms said they will focus on women over the next three years. This strategy is leaving out half of the population–which currently controls over a third of the world’s wealth. Firms should stand up and take notice of this influential client segment.

Tech as a deciding factor

Although to varying degrees, technology will play a critical role in attracting most if not all of the above pools of potential customers. Making the most of digital tools is one of the most accessible ways for investment firms to access these new demographics as is the use of data and new AI-powered applications.

Naturally, the younger generation, as digital natives, is the group most keen to see investment firms providing digital tools—and those that not only help facilitate their transactions but also allow them more autonomy over their investments. As the report found, among Gen Y and Z, 74% expect their wealth managers to offer digital experiences on par with leading digital companies. More than 60% want better digital tools so they can manage their investments directly, and 52% say they want access to AI-enabled chatbots to answer queries. Right now, robo-advisors have been successful at catering to these demands—and other investment businesses may need to catch up.

To attract mass market and non-domestic customers, wealth managers will also need to step up their technology game, making use of data analytics to personalize services for these markets. That means capitalizing on data about investor behaviors and trading patterns as well as seeking out external open-source data from social media.

With the goal of building strong relationships early on with investors, many large institutions have already started using digital tools to offer hybrid advice—which combines the best of human-based financial advice with digital advice—and other digital techniques to engage with the mass market. And for some countries, according to the report, more than 50% of those surveyed said digital applications, channels, tools, and platforms were key to their selection of wealth manager.

Wealth solutions tailored to the unique needs of women should also be a priority—and advancements in technology can help here, too. Right now, the lack of female advisors—only around 30% of all advisors in the US—can be an obstacle to serving female customers: one survey found that 70% of women seeking a financial adviser would prefer to work with a woman. Now with the dawn of hybrid working models enabled by technology, the profession could be more attractive: according to Deloitte’s Women @ Work 2023: A Global Outlook survey, two-thirds of women planned to stay for more than three years at a job when they had work flexibility.

People first

Ultimately, understanding the customer is about more than just data, demographics, and digital tools. But these are critical means to an end: that is, providing the best and most personalized investment experience. With that as their North Star, wealth managers should be able to use technology as a defining factor in their quest to attract the next life-long client.

August 2024, CICO writer Staff Reporter Neil Tomlinson

6 AI Tools Recommended By Teachers, That Aren’t ChatGPT

Artificial Intelligence is revolutionizing how teachers engage students.

I reached out to classroom teachers around the world on LinkedIn, X (formerly Twitter) and Facebook to find out which AI platforms are having the most impact in their classrooms. The response was overwhelming, so much so that there will likely be a part two to this exploration. While many educators are using leading AI chatbots such as ChatGPT and Google Gemini, platforms designed specifically for educators and students are offering more specialized functionality.

Here are six AI tools making waves in classrooms worldwide:

- Brisk Teaching

- SchoolAI

- Diffit

- Curipod

- Skybox by Blockade Labs in ThingLink

- Ideogram

With insights from educators who are leveraging their potential, let’s explore them in more detail.

Six Tools For Education

Brisk Teaching

Darren Begley, a teacher of modern studies and history at Fernhill School in Scotland, explained that in his classes his students have to understand a lot of complicated content: “Brisk is a great tool in making it more accessible for young people, opening up a wider range of topics of study. It has been immensely powerful in increasing political literacy and engagement in my classroom.”

Brisk Teaching offers an AI-powered Chrome extension for educators that can help when creating curriculum, giving feedback, assessing student writing, adjusting reading levels and translating texts. It integrates with tools like Google Docs and Slides, to help teachers to generate quizzes, lesson plans, rubrics and presentations efficiently.

SchoolAI

Alyssa Faubion, a teacher in El Paso, Texas, expressed her passion for using SchoolAI: “I love using SchoolAI with students because it offers personalized learning experiences, tailoring content to meet each of my student’s unique needs and preferences. There are pre-made spaces that make it user-friendly for educators to explore without knowing how to prompt. It’s a great replacement for ChatGPT for students and allows teachers to monitor through the mission control.”

SchoolAI is an AI platform designed for K–12 classrooms, offering personalized tutoring, guidance, and support. Teachers can create custom AI bots to help students with their learning, monitor student progress and set controls to keep AI on task. The platform includes real-time insights to help teachers engage and support students.

Diffit

Bonnie Nieves, a science teacher in Dudley, Massachusetts, explained that she uses Diffit because it “creates differentiated thinking and writing activities from any material, website or prompt.” She loves that it “Translates to multiple languages and reading levels.” and that the “Premade graphic organizer templates encourage logical thinking, collaboration and build student self-efficacy because of the scaffolded support.”

Diffit is a platform designed for teachers to create learning materials quickly and easily. It generates leveled content tailored to students’ reading abilities. Users can input text or topics and Diffit produces customized versions that are accessible to various reading levels.

Curipod

Aileen Wallace, a teacher in Scotland, is a big advocate for Curipod and posted: “It enables me to devise engaging lessons that boost the confidence of even the most reserved students. Utilizing AI-generated feedback with a customizable rubric has significantly improved the responses from my students. When they come into class keen to use it, you know it’s effective.”

Curipod is designed to enhance classroom engagement through interactive, AI-assisted lesson planning. Teachers can generate lessons on any topic using AI, which helps create polls, personalized feedback, word clouds and other interactive elements to spark curiosity and participation among students.

Skybox by Blockade Labs in ThingLink

Christoffer Dithmer, a teacher in Denmark, loves using the Skybox image generation tool integrated into ThingLink: “Skybox in ThingLink allows students and educators to bring their thoughts and ideas to life with 360-degree AI universes. The tool is ideal for demonstrating scientific phenomena or visualizing stories and fairytales. The tool is accessible so that all students can succeed with their projects with multiple communication tools.”

ThingLink is a platform that enables users to create interactive experiences with images, video, and 360° media. The integration of Skybox by Blockade Labs means that teachers using ThingLink can now use AI to generate bespoke 360° images. These images can be annotated and customized in various styles for interactive learning experiences, gamified lessons and immersive storytelling.

Ideogram

Matt Miller, a teacher and author from Indiana, shared his love for Ideogram: “Finding images to teach vocabulary has been a challenge. But when you can generate custom images based on specific vocabulary, it’s a dream. In my Spanish classes, we were studying animal vocabulary and sports vocabulary. Custom images of animals playing sports were a hit, and really effective for vocabulary repetitions.”

Although Ideogram is not specifically an education tool, it allows teachers to create and design visual content. It provides tools for generating images based on text descriptions, making it easier for users to visualize concepts and ideas.

The Potential To Transform The Classroom

These six tools are just a few of the many platforms that were shared by educators around the world. To search for other AI platforms being used in education, many educators use the AI Educator Tools repository.

Before integrating any digital platform into your classroom, it is crucial to follow your organization’s procedures regarding data protection. Always seek guidance from the people responsible for this in your school, college or university.

The teachers I speak to are saving many hours per week using tools such as the ones above. When integrated in a safe way, AI has the potential to transform the practices of any teacher. This could be you.

May 2024, CICO writer Staff Reporter Dan Fitzpatrick

TikTok USA.

On December 22, 2022, the world’s understanding of TikTok changed. The social media giant admitted that a China-based team of employees at its parent company, ByteDance, had tracked the location of journalists, including this reporter, just three months after Forbes reported on its plans to surveil American citizens.

It was concrete evidence of something that American lawmakers have feared for years — that TikTok could be used to spy on Americans. The U.S. Government has long worried that the Chinese government could require ByteDance to either use TikTok to surveil Americans or try to influence our civic discourse. Today, the House of Representatives passed a bill that would require ByteDance to divest from TikTok, or, if it refuses, ban the app in the United States, and President Biden has said he will sign the bill if he has the opportunity to do so. Whether that will happen is now in the hands of the Senate, where lawmakers are debating behind the scenes about whether they should introduce and pass an equivalent measure or not.

Over the last two years, Forbes has revealed again and again how deep TikTok’s ties are to its Chinese parent company ByteDance — which remains beholden to the Chinese government — and how that could pose a risk to national security.

In summer 2022, BuzzFeed News reported that TikTok users’ private information was widely accessible to ByteDance employees in China, and that another ByteDance app had been used to push Chinese propaganda to people in the United States (ByteDance denied that this had occurred). Since then, Forbes has reported that the U.S. Department of Justice opened a criminal investigation into ByteDance for its surveillance of journalists. It revealed that ByteDance had monitored conversation about topics sensitive to the Chinese government, using over 200 “sensitive word” lists to do so.

Moreover, despite testimony from CEO Shou Zi Chew to the contrary, Forbes revealed that the company has continued to keep some data about its American users — including many of its most popular influencers — in China. This led some lawmakers to accuse Chew of perjury and request that the Justice Department open an investigation into his testimony.

Concerns about TikTok have been largely bipartisan; former President Trump first tried to ban TikTok in 2020. Since President Biden took office, his administration has remained skeptical of TikTok, despite his campaign’s decision to join the app last month. In March 2023, an interagency panel made up of Biden appointees told ByteDance that it would have to divest from TikTok, or face a ban on the app.

This marked an apparent stalemate in a years-long negotiation between TikTok and the government to reach a national security agreement that would impose restrictions on TikTok, but allow ByteDance to continue to own it, via a complex potential partnership with Oracle and a data sequestration initiative known as “Project Texas.” Forbes was the first newsroom to report on the contents of the draft agreement. But with this new bill, the Biden Administration has indicated that draft agreement — which would grant the U.S. government unprecedented power over online speech — was still not enough.

This week, TikTok prompted its 170 million American users to call their representatives and express opposition to the new House bill. Moreover, former President Trump reversed course and came out against a TikTok ban, scrambling the Biden Administration’s coalition. Still, with bipartisan momentum at an unusual high, it remains to be seen whether Trump’s reversal will be enough to save TikTok.

April 2024, CICO writer Staff Reporter Rashi Shrivastava

Making Remote, Work.

In the wake of a global shift toward remote work, businesses and employees alike have encountered a transformative opportunity to redefine productivity and job satisfaction. This flexible, efficient and employee-centric approach has challenged the conventional 9-to-5 office model, characterized by long commutes and fixed-location workspaces.

This article explores the inherent problems with traditional work settings, proposes solutions for a remote work future and highlights the benefits of embracing this model.

The Challenges With The Traditional Work Model

In the years after the Industrial Revolution, the world of work saw a seismic shift from 16- to eight-hour work days, primarily due to work-life balance. In addition to the market benefits, Henry Ford remarked that shorter hours increased productivity and reduced absenteeism.

Yet, with all of the technological advances in our society, we have only re-evaluated the work model once the pandemic forced us to.

Before the Covid-19 pandemic, employees often spent upwards of eight hours at the office, yet not all of this time was productive. Businesses were paying for eight hours of physical presence rather than production. The distinction between motivated and less engaged employees becomes blurred in a setting that values physical presence over actual output.

Post-Covid, many businesses have adhered to outdated processes and have suffered financially due to underutilized office spaces and loss of motivated employees. The insistence on a physical workplace overlooks technological advancements that enable effective remote collaboration.

Moreover, the traditional billing of 40 hours per week emphasizes time spent over the quality and quantity of work accomplished, which is an arbitrary practice.

How To Succeed With Remote Work

Transitioning to remote work, however, necessitates comprehensively reimagining how we approach communication, motivation and organizational structures to maintain and enhance productivity.

With communication, for example, it is vital to implement a joint status board accessible to all stakeholders—including clients, developers, testers and customer support—to provide a granular view of project statuses. This board should be linked to a roadmap dynamically tied to issues, ensuring that the roadmap communicates each project’s real-time, at-a-glance status.

Regarding motivation, we can draw inspiration from self-motivated fitness apps, which can be beneficial, where progress and achievements are continuously acknowledged, creating a positive feedback loop. Additionally, allowing peers to vote for top performers can foster a competitive yet supportive environment, encouraging everyone to contribute.

The organizational structure should support these initiatives. Project managers (PMs) are crucial in prioritizing the board for the most significant impact, creating issues, managing resource availability and overseeing the budget. Developers, on the other hand, can be tasked with creating detailed “steps” for each issue and performing daily status updates by checking off completed steps. The system must be intelligent enough to raise red flags for issues at risk of falling behind schedule, suggest pairing developers on challenging tasks and assign issues based on priority, ensuring the workflow remains smooth and efficient.

Successful remote work environments are also built on clear expectations and robust team structures. Key strategies include:

• Establishing core meeting hours.

• Meetings that are small and focused on specific problems.

• Promoting video engagement during calls to foster connection.

• Automating collective and individual status reports.

• Sharing road maps across levels, updating in real time and conveying status at a glance.

Moreover, teams should encompass core functions such as product support, strategy, development, communication and customer support to ensure comprehensive coverage of business needs. With this in mind, oversight in a remote setting can be democratized by allowing team members to provide feedback on each other’s performance, fostering a culture of accountability and transparency.

Encouraging self-competition and establishing a feedback loop where consistency and exceeding personal bests are rewarded can enhance productivity and job satisfaction.

Conclusion

The shift to remote work offers numerous advantages for businesses, employees and society. Reduced overhead costs for businesses, the emergence of new industries and the distribution of capital across more diverse geographical areas are just a few of the economic benefits. Employees gain invaluable time, improving their work-life balance and overall well-being.

Remote work also democratizes opportunity, allowing companies to source the best talent regardless of location and enabling individuals to live and work where they choose, not just in major urban centers. This geographical flexibility can lead to more diverse and innovative teams and contribute to decentralizing economic activity from traditional urban hubs.

The future of work is unequivocally remote. This model addresses the inefficiencies and limitations of the traditional office and offers a framework for a more balanced, productive and satisfied workforce. By embracing remote work, businesses can thrive in a digital landscape, harnessing the benefits of technological advancements to create a more equitable, efficient and flexible work environment.

The transition requires a reevaluation of long-held norms and an openness to restructuring how we work, communicate and collaborate. The rewards, however, promise a revolution in how work is perceived and executed, heralding a new era of productivity and job satisfaction.

March 2024, CICO writer Staff Reporter Jacob Cheriathundam

TikTok Owner ByteDance Quietly Launched 4 Generative AI Apps Powered By OpenAI’s GPT.

The websites and policies for new apps Cici AI, ChitChop, Coze, and BagelBell don’t mention that they were made by ByteDance.

TikTok’s Chinese parent company, ByteDance, has quietly launched four new generative AI apps for users outside of China, Forbes has learned. Dubbed Cici AI, Coze, ChitChop, and BagelBell, the apps were all launched in the past three months and collectively have millions of downloads.

Cici AI, ChitChop, and Coze are bot creation platforms that let users make and share their own chatbots. BagelBell generates the plot and text of fictional stories that change based on readers’ choices. But ByteDance did not build the underlying large language models that power them. Instead, the apps rely on OpenAI’s GPT technology, accessed through a Microsoft Azure license, according to ByteDance spokesperson Jodi Seth.

Why Is TikTok Parent ByteDance Moving Into Biology, Chemistry And Drug Discovery?

TikTok’s Chinese parent is beginning to recruit across the U.S. for experts in science and healthcare disciplines far afield from social media. Its motives are unclear.

ByteDance, the Chinese parent company of TikTok, appears to be ramping up work in fields well beyond the bounds of social media: Biology, chemistry, natural sciences and pharmaceuticals.

The Beijing-based tech giant is recruiting American talent in computational biology, quantum chemistry, molecular dynamics and physics for its “AI for Drug Design” and “AI for Science” teams, according to LinkedIn posts reviewed by Forbes. ByteDance appears to be hiring for at least 17 of these positions across New York, California and Washington state—taking a swing at local rivals like Meta, Google and Amazon, where similar work is already underway. (Others leading these efforts at ByteDance appear to be based in Chicago, Boston and Beijing, according to LinkedIn.)

The AI for Drug Design team aims to “revolutionize drug discovery,” says one job listingrecruiting PhD students to Silicon Valley. “We are dedicated to pushing the boundaries of AI-driven drug design, tackling complex challenges in protein structure prediction, molecular conformation analysis, and computational protein design. By combining our passion for scientific excellence with the transformative power of AI, we aim to accelerate drug discovery and make a meaningful impact on global healthcare.”

ByteDance’s AI for Science group, meanwhile, “has been focusing on tackling challenges in natural sciences, including biology, physics, and materials,” say listings for research scientists in computational biology and quantum chemistry in Seattle. And those interning in molecular dynamics in New York will be responsible for pursuing “novel strategies for computer-aided drug discovery” and advancing “free energy methodologies.”

What, exactly, that future is to be isn’t clear. It is also unclear how drug discovery or development, and other science-focused efforts, fit into ByteDance’s sprawling repertoire of social media sensations like TikTok and its Chinese counterpart Douyin. ByteDance declined to comment on what its objectives are, how large the AI for Drug Design and Science teams are today and who it may have already hired. But a head of AI for drug design and science started at the company this past summer, per LinkedIn—an expert who is also running UCLA’s General Artificial Intelligence Lab—and the team has already released research on protein design and drug design, and an open-source toolcombining structural biology with AI.

TikTok did not respond to requests for comment.

How TikTok could help.

Forbes found no indication that these ByteDance initiatives are related to TikTok, and TikTok did not respond to a request for comment about whether they are in any way linked.

But experts said data from TikTok and other platforms owned by ByteDance could be highly valuable for these science initiatives. (And though TikTok has emphasized that it operates largely separately from its Chinese parent, Forbes reporting has repeatedly revealed the extent to which the businesses are entangled and data from one company is often accessible by both.)

“They could be doing large-scale hypothesis generation with all this data, and then they could be feeding that data into Chinese pharmaceutical companies or Chinese weapons manufacturers.”

In the development of new drugs or medical treatments, experts and pharmaceutical companies typically work around what’s called a “target product profile,” a rubric that helps them distill what their optimal drug would look like, the conditions or key problems they’d address with it and who their ideal patients, candidates or markets are. Experts said TikTok—where many people are drawn to health and wellness content, talk openly about medical issues, and regularly seek information on what has (or hasn’t) worked for others—could serve as an invaluable feedback loop and marketing tool for drug developers. Spending data collected from TikTok Shop and in-app purchases could also be useful.

“Based on the kinds of videos that [young TikTok users] watch or the content that they consume, it might provide insights as to conditions that they’re facing,” said Douglas Schmidt, associate provost for research and co-director of the Data Science Institute at Vanderbilt University, who noted that many young Americans are medicated for ADHD, anxiety and other mental health conditions. “If you could find a way to sell products that would be appealing to them, you can certainly imagine [building] up a robust pharmaceuticals industry or a competitive product, then advertising it on TikTok.”

Eric Perakslis, a former chief scientist for the FDA who previously helped lead pharmaceuticals R&D for Johnson & Johnson, called this “surveillance capitalism basics: everything that you can extract from those things, they do.”

“Given that they’re a social media company, and given that they don’t have life science divisions that are consenting patients, taking samples or running mice and rat studies and stuff like that—their own data—I think it’s a fair assumption that somehow they’re accessing data” from elsewhere, said Perakslis.

This growing arm of ByteDance could be a “very big, large antenna,” he added—a way of pulling in a “big noisy mess of data,” filtering it through experts and then figuring out how to monetize it.

“They could be doing large-scale hypothesis generation with all this data, and then they could be feeding that data into Chinese pharmaceutical companies or Chinese weapons manufacturers or Chinese whatever,” Perakslis said. (ByteDance’s head of research appears to be based in Beijing, per LinkedIn.) Beyond drug discovery or repurposing, he noted the language used in these roles could also portend work in food science, agrochemical, petroleum, fuels science or even bioweapons. “The same technologies that allow us to develop new medicines can be used for bioweapons,” Perakslis said. “It’s a very similar set of capabilities.” Finally, experts said the roles signal that TikTok’s owner is looking to channel its AI prowess—embodied best by the unmatched TikTok algorithm that steers its ultra-personalized “For You” feed—into other revenue streams. That hypothesis jibes with the job descriptions: Those joining ByteDance’s “multidisciplinary drug discovery team” will be tasked with “applying inventive algorithms” to its work and developing algorithms for antibody design. Other hires will build “cutting-edge machine learning technologies in scientific areas like biology, physics and materials.”

State of play.

This is not the first time that ByteDance—which established the ByteDance AI Lab in 2016—has ventured into industries that seemingly have little to do with TikTok, Douyin and social media more broadly.

Healthcare is just one of many. Last year, ByteDance bought Chinese hospital chain Amcare for $1.5 billion—a push to establish a foothold in the space after ByteDance had acquired online medical encyclopedia Baikemy in 2020 and subsequently launched a suite of healthcare apps under the name Xiaohe. Experts at the time told Forbes those moves reflected the Chinese government’s mandate for the country to be a global leader in health by the end of this decade.

What’s different now, though, is that ByteDance appears to be expanding those efforts beyond China into the United States—hiring scientists and PhDs in at least three major U.S. cities. And in doing so, it’s planting a flag in a market where some of its biggest American competitors have their own science, research or health-focused initiatives underway and edging into their AI research talent pool.

“They’ve attracted a lot of negative publicity about TikTok. … Maybe they’re trying to diversify into fields that are viewed more positively by governments and regulators.”

Like ByteDance, these U.S. rivals are tech behemoths that are trying to win in industries well outside their bread-and-butter businesses. Google parent Alphabet is pursuing breakthroughs in tech and science through its Moonshot Factory (previously called Google X). Google DeepMind, the search giant’s innovation lab for AI and neuroscience, recently released a model that can mimic human reasoning. Meta AI, a research hub from the parent company of Facebook and Instagram, is transforming medicine by deploying AI to improve and expand access to MRIs and help doctors read and make predictions off X-rays. And Amazon has had its own foray into healthcare, acquiring OneMedical in 2022. (TikTok Shop, which the platform launched in the U.S. in September, is also a growing threat for Amazon.)

“They’re undoubtedly trying to find a way to leapfrog or get access to people with skills in those areas,” said Schmidt, the professor from Vanderbilt.

But ByteDance’s segue into the sciences could also simply be a way for the Chinese company to improve its goodwill in the U.S. as talks of a TikTok ban loom and the app faces heavy scrutiny for its effect on the American public and discourse, he added.

“They’ve attracted a lot of negative publicity about TikTok and its corruption on the youth of America,” Schmidt said. “But when we start thinking about healthcare and science, that comes across as more corporately responsible and trying to help for the good of humanity. … Maybe they’re trying to diversify into fields that are viewed more positively by governments and regulators.”

After all, as ByteDance says itself: “Our goal is to create breakthroughs in natural science with new methodology and help the world.”

A Secretive $10 Billion Firm Backed By WhatsApp Billionaire Jan Koum Is Quietly Building A Startup Portfolio.

Led by former Sequoia partner Michael Abramson, two-year-old Newlands already holds billions in equities like Alphabet, Amazon and Meta alongside a smattering of early-stage startup bets — and then there’s crypto flameout FTX. No one involved wants to talk.

n the early months of the pandemic, Michael Abramson returned home to Texas to plot his next career move. A former partner at storied venture capital firm Sequoia Capital, he’d kept a low public profile despite investments in flashy startups like beauty retailer Glossier and delivery app Rappi. Hoping to maintain that quiet approach in his next endeavor, he pinged a friend with a similar penchant for privacy, and billions of dollars to invest: WhatsApp billionaire Jan Koum.

Today, with Koum’s support, Abramson quietly leads Newlands, a firm that has rapidly grown into one of the largest new funds in tech. Abramson and Koum haven’t spoken publicly about Newlands, and the firm does not appear in recent funding announcements. Its corporate website is little more than a shell. But regulatory filings reveal a firm that holds nearly $10 billion in public equities, mostly tech stocks, and is beginning to make investments in the early-stage startup ecosystem.

Some peers consider Dallas-based Newlands to be effectively Koum’s family office, deploying some of a fortune that Forbes values at about $15 billion, and filings link Koum to Newlands. But Newlands also doesn’t look like a typical family office, experts who reviewed its public filings on behalf of Forbes said.

The extent of Newlands’ size beyond its public holdings isn’t easily assessed; Abramson and Koum didn’t respond to requests for comment, nor did three other investors known to work at the firm. But conversations with a dozen peers and former or current collaborators — all of whom asked to remain anonymous because they weren’t authorized to speak or feared retaliation — reveal a fund that has built an eye-popping portfolio of some of tech’s buzziest public companies and is meeting and backing a number of other startups to grow it further.

“They have a great network, and they’re bought into a lot of stuff,” said one investor familiar with the firm. “They want to support people in the broader ecosystem — and also preserve and grow their wealth.”

When Sequoia doubled down on its early-stage investment in WhatsApp in 2013, Abramson was a key member of the team that worked closely with Koum, an immigrant from Ukraine whose messaging app had reached 200 million users. The two connected, in part over a shared aversion to the limelight. In a rare interview for a 2014 Forbes cover story, Koum recounted not sharing his employees’ enthusiasm when WhatsApp reached the top 20 apps on Apple’s App Store. “Marketing and press kicks up dust,” he told them. “It gets in your eye, and then you’re not focusing on the product.”

“Newlands is Jan and the partners’ money — and their money is a drop in the bucket.”

Fake Profiles And Anonymous Posts: How Social Media Is Upending College Life During The Israel-Gaza War.

From his early days at Sequoia, the Texas native Abramson had also become known for a similar disdain for public attention. A Harvard and Stanford Business School graduate, he’d originally joined a public/private crossover fund affiliated with Sequoia, Sequoia Capital Global Equities, then ended up on the growth team of Sequoia Capital, the venture firm. Investor peers knew him as “a good guy” who had the ear of Michael Moritz, the legendary Google and Stripe investor who previously led the firm’s global operations, and who was named co-lead of its growth team alongside partner Pat Grady in 2017. But Abramson was also on “the extreme side of introverted,” several sources said. “He’s an investor, not a hunter who would get out in front,” added one. “He has a pretty tight network.”

Working with Rappi, the Latin American on-demand app that Abramson backed in a Series B funding round in 2016, Abramson “knew the numbers cold,” a fellow Rappi investor said, but stood out as seemingly ill-suited to play the company politics beneficial at a large, hard-charging VC firm, a fellow Rappi investor said. “He was more low profile, but super responsive over email,” another said. Abramson gave a statementfor Glossier’s press release when he backed the beauty retailer in 2019, but didn’t become known for the deal like other backers. Behind the scenes, “he made a strong impression as being super sharp and inquisitive or engaged,” a fellow Glossier investor said. The founders of Rappi and Glossier didn’t respond to requests for comment.

But Abramson was holding only one board seat for Sequoia by 2020, weight-loss unicorn Noom (lead partners at growth funds will often hold eight or more). He’d given another statement for its 2019 funding press release, too, alongside Koum, who personally invested. His signature bets — Rappi, previously valued at $5 billion, Glossier, previously valued at $1.8 billion, have yet to go public or be acquired, while Noom, once valued at $3.7 billion, has battled controversies and conducted multiple rounds of layoffs. When Abramson departed Sequoia in the fall of 2020, with the U.S. still under Covid-19 shutdowns, he did so without fanfare. The firm wrote privately to its limited partners that Abramson had left the firm in order to move closer to family.

As he tinkered with different ideas, Abramson gravitated toward a reunion with Koum. The two had developed a close friendship following WhatsApp’s $22 billion sale to Facebook in 2014, even vacationing together, according to a source. Hiring two other SCGE alumni, Andy Shah and Dominik Pasalic, they launched Newlands in 2021 with the intention of running a $1 billion fund, the source added, before quickly expanding its scope. But they kept quiet. A filing from Massachusetts, where the firm hired a general counsel and chief compliance officer, is the only public document that directly connected Newlands to Koum. On LinkedIn, where Koum keeps a spartan presence under the name Jan K., he lists himself as a Newlands employee with the wry role of “QA testing,” or quality assurance. (Abramson’s LinkedIn page is even more sparse, without a photo. He, like others at the firm, calls himself simply an “investor.”)

“Newlands is Jan and the partners’ money — and their money is a drop in the bucket,” one investor who knows the firm said.

“Michael was a great partner in the building of our U.S. growth business,” Grady wrote in a statement. “He remains a close friend of Sequoia and we wish him continued success.”

So far, Newlands appears to have mostly invested in public tech stocks. Firm employees have told others that they expect to deploy about half its capital to such equities, with another 30% for startups and 20% earmarked for cryptocurrencies and investments in other funds, according to one source. But the public side has accounted for more than 80% of its activity so far, another source said.

A November filing by Newlands reported its public portfolio as holding $9.4 billion in assets to close the third quarter, flat from the previous quarter. The fund’s biggest positions: nearly $3 billion in shares of Meta, Koum’s former employer; a nearly $1 billion stake in Elon Musk’s Tesla; $800 million-plus positions in Alphabet and Amazon, and a $500 million-plus position in DoorDash. Newlands also holds $100 million-plus positions in Zoom, Shopify, Microsoft, Workday, Bill.com, JD.com, Netflix, Robinhood, Snowflake, DocuSign and Salesforce. Smaller positions include Alibaba, Datadog, Gitlab, PayPal, Coinbase, Moderna and Sprinklr.

Compared to its previous quarterly filings, Newlands’ holdings have grown considerably since it reported a public portfolio value of $5.6 billion to close Q1 2023, and $3.8 billion for the quarter before, the first period for which it filed. (Investment managers that “exercise investment discretion” over $100 million or more of securities must report such holdings quarterly to the SEC.) It typically only held or increased its positions, with some especially large purchases of Alphabet, Amazon, DoorDash, Bill.com, JD.com and Robinhood. Most recently it took positions in Chinese online retailer Pinduoduo and financial services giant Charles Schwab Corporation, sold its stake in Kraft Heinz and made modest investments in software businesses: Braze in customer engagement, and Procore in construction management.

“Michael is very risk-reward focused, and the public stuff is more attractive for risk-reward right now, so that’s where they spend their time,” said one investor peer.

Still, Newlands has begun to make startup investments, too, even as it works to keep them quiet. Startup funding tracker PitchBook lists no entry for the firm or recent deals by Abramson or Koum, and they’ve stayed out of any recent press releases. Crunchbase lists Newlands as having participated in Series A funding rounds for two data infrastructure startups this year, Kloudfuse and Lightup. Neither responded to a comment request.

Forbes also contacted three other startup CEOs named by sources as having taken Newland investment. One said they were familiar with Newlands but denied meeting the firm or taking its money. A second told Forbes that Newlands had asked it not to comment. A third didn’t respond.

One investment Newlands couldn’t keep quiet: a reported position in FTX, the bankrupt crypto exchange formerly led by former billionaire and convicted felon Sam Bankman-Fried. Newlands invested alongside Abramson’s previous firms, Sequoia Capital and SCGE, according to a report by The Information. And both Abramson and Koum were named on behalf of Newlands on a list published by Newcomer of advisors for FTX’s final fundraising push before its collapse in late 2022, alongside Sequoia’s Alfred Lin and former Sequoia partner Matt Huang of Paradigm, another FTX investor.

While the firm has made a number of relatively small, under $1 million early-stage bets, according to a source, Newlands hasn’t formalized a startup investment strategy or hired an investor to execute it full-time. But the firm has approached other funds about co-investing in deals they led, another source said.

The overall size and scale of Newlands’ operations remain a mystery, as does the total percentage of Koum’s $15 billion fortune now managed by the firm. The firm’s multi-billion-dollar Meta position could be shares it manages on behalf of the billionaire or two family trusts, each of which has received millions of such shares from Koum in the past, per filings. If the trusts were grantor trusts, Koum could have also swapped in other assets, such as cash, to transfer shares to Newlands without tax implications, said trusts expert Beth Shapiro Kaufman, a partner at Lowenstein Sandler and chair of its national private client services group.

“I think they’re redefining what it means to be a family office.”

Venture capital peers have referred to Newlands colloquially as Koum’s family office. But experts who reviewed its filings said Newlands looked more like a hedge fund or special purpose vehicle. Newlands refers to itself as a “global investment partnership” on LinkedIn, where several of the 11 employees listed include finance, tax and accounting specialists with previous roles at EY and Maverick Capital, a prominent Dallas hedge fund.

“Normally, a family office is grossly under-capitalized, where people play games to convert expenses into deductible ones,” Kauffman said. “Their employees produce financial statements, do tax returns, hire the nanny and handle buying a new car. They run these peoples’ lives for them in whatever respect the client wants.”

Newlands, by comparison, looks more like a hedge fund manager, said Brian Buehler, a managing partner of Triton Pacific Capital Partners, a Los Angeles-based private equity firm. But ultra-high net worth individuals have been known to hire investors with venture capital or hedge fund backgrounds to manage their portfolios, sometimes taking aggressive public-equities strategies. And sometimes a fund looking like Newlands may draw its capital from a separate legal entity representing a person or family, he added. “There’s no ‘normal’ in family offices,” Buehler said. “But this seems more than a decade ago, Koum’s former boss Mark Zuckerberg, the billionaire Facebook cofounder, parked some of his wealth with a new-look investment advisory firm, Iconiq Capital, that quietly grew an outsized profile by taking on more funds from wealthy tech founders and pouring much of it back into the next generation of startups. Abramson and Koum could aspire for a similar evolution for Newlands someday. Or maybe it will look more like Maverick, which ‘Tiger Cub investor’ Lee Ainslie launched 30 years ago with the backing of another billionaire, Sam Wyly, who later went bankrupt. For now, such talk is just speculation. What is known: Newlands is out in the market, it’s backing a new wave of tech entrepreneurs, and the buck stops with Koum. “I think they’re redefining what it means to be a family office, reframing it a bit away from a pejorative,” said a source with knowledge of Newlands’ thinking. “They’re happy to have the freedom to invest how they want.”

December 2023, CICO writer Staff Reporter Alex Konrad

Kathleen Margaret Connelly has inflammatory thoughts about the Israel-Gaza war. She’d been sharing them regularly with her more than 2,000 Facebook “friends” since Hamas violently massacred 1,400 people in Israel, and kidnapped hundreds more, on October 7, prompting Israel to launch a deadly offensive aimed at decimating Hamas in Gaza. As an apparent employee at the University of Pennsylvania—with a PhD from Penn, a master’s from Georgetown and a bachelor’s degree from Fordham, according to her Facebook—Kathleen’s voice, and anti-Israel diatribes, held weight. But Kathleen Margaret Connelly isn’t real. There is no record of her ever attending, graduating from or working at any of these schools, they all confirmed to Forbes. And the striking green-eyed, red-haired woman who appeared in Kathleen’s Facebook profile picture is, in fact, a young actress in Dublin who told Forbes she was not aware the account had been using photos of her face for well over a year. As the Israel-Gaza war crosses the one-month mark, college campuses across the United States are facing an ideological reckoning and have become ground zero for protests, counter protests and debates over hate speech and freedom of expression. But mainstream social media platforms, as well as those geared toward college students, are increasingly becoming vehicles to spread threats, stir up fear and sow division at American universities, including by agitators who may not even be part of the school community. Anonymous emails are similarly being weaponized. In an email obtained by Forbes, the director of the Penn Museum—where Kathleen purported to be employed as a “cultural anthropologist”—wrote to the Museum Board and other leaders about the fake account. He described its “disturbing social media posts… that contain hate-filled messages and antisemitic content” and said the school believed it to be “an AI-created fake account designed to sow discord.”

Penn did not respond to multiple requests for comment about whether it has identified other fake social media accounts like Kathleen’s—impersonating students, staffers or alums—posting content seemingly intended to inflame student conversations about the war. But this week, Penn president Liz Magill said the FBI and Penn Police were investigating a potential hate crime on campus after an unknown sender emailed threats against the school’s Jewish community, and specific buildings, to several Penn staffers. The Daily Pennsylvanian reported that “undisclosed individuals” have also used social media and email to threaten people at Penn who’ve voiced support for Palestinians. And last week, following an FBI investigation into anonymous threats that targeted Jewish students at Cornell, a 21-year-old student was arrested on a federal criminal complaint and charged with “posting threats to kill or injure another using interstate communications.” (Disclosure: I graduated from Penn over a decade ago.)

The Cornell threats were shared on top college-focused site Greekrank—where users can post anonymously about life on campus without needing school credentials—and similar problems are playing out on rivals like Sidechat and Yik Yak. (Those two require a school email to sign up, but Forbes was able to register and post using a .edu address that is more than a decade old. Neither responded to a request for comment.) Across a range of platforms, the easy masking of individuals’ identities is intensifying discord and outrage between Gen Z supporters and critics in all corners of the conflict.

“Social media is only escalating an already emotionally charged and tragic conflict,” said Penn junior Allison Santa-Cruz, who recently penned an op-ed in the student newspaper about the effect of tech platforms on the Penn community.

“It is extremely dangerous for fake social media accounts to pose as students, faculty, or administrators and post inflammatory, divisive material and misinformation online,” she added. “Especially now when people are routinely punished for what they say online and in the era of cancel culture, these poser [social] accounts are more dangerous than ever.”

An old problem in a new frontier.

It’s not unusual to see suspicious, potentially dangerous social media activity aimed at shifting public opinion or inflaming discourse during high stakes national and global events. In recent years, for example, Meta—the parent company of Facebook and Instagram—has uncovered so-called influence operations and taken down networks of accounts and pages working in tandem to mislead or deceive people using its platforms. (A number of these have originated from China, Russia and Iran, and some targeted the U.S. during recent presidential and midterm elections.) But now, in the midst of a war with no end in sight, some experts fear that American colleges are an easy target for individuals and groups, inside or outside the student body, looking to stoke discord and wreak havoc.

“[These] accounts don’t necessarily try to change anyone’s mind; they try to heighten polarization by encouraging Americans to go for each other’s jugular.”

“Why university campuses? Because they are hotspots in the debate about the Palestinians, Hamas and Israel,” said misinformation researcher Paul Barrett, who is deputy director of the NYU Stern Center for Business and Human Rights. “College and grad students are already passionately divided over who is to blame for the strife in the Middle East,” and fake or anonymous social media accounts “[appear] to be egging them on, trying to get both sides more riled up.”

Adversaries have long “specialized in trying to exacerbate division within U.S. society,” Barrett added, citing Russia as a key example. “Russian accounts don’t necessarily try to change anyone’s mind; they try to heighten polarization by encouraging Americans to go for each other’s jugular.”

The Facebook account purporting to be Ivy League grad and current Penn Museum employee Kathleen Margaret Connelly wasn’t new, either. Before the Israel-Gaza war began, the account was fomenting anger around the Ukraine-Russia war—promoting Russia, attacking Ukraine and going so far as to suggest that Ukrainians are Nazis. Other posts championed China and cast doubt on vaccines.

But Kathleen shifted her focus at the start of the war in the Middle East to attack Israel. She called for “the end for Israel,” accused Israel of “ethnic cleansing” and spread misinformation about the conflict—including false claims about the now well-documented horrors at the music festival where Hamas brutally murdered at least 260 people, and kidnapped others, on October 7. “No one was killed at the concert; witnesses say Hamas treated people with kindness,” Kathleen shared in a photo on October 14. The U.S. government has designated Hamas as a terrorist organization and several of its members as terrorists.

“On a college campus… individuals are retreating to dangerous ideology and doing the dirty work of terrorist regimes.”

“Each person who spreads information [through social media] has the responsibility to make sure it is not misinformation, promotes violence, or signals a message that is not aligned with morality,” said Penn senior Eyal Yakoby, who is focused on political science and modern Middle East studies. “On a college campus, where you would think these principles are being upheld and emphasized most, individuals are retreating to dangerous ideology and doing the dirty work of terrorist regimes.”

It remains unclear who is behind Kathleen’s account.

“The account strikes me as a very generic ‘American woman’ which could just signal that it was made to boost engagement, or was an anonymous account of someone who didn’t want to be known for their political beliefs,” said disinformation expert Joan Donovan, author of Meme Wars: The Untold Story of the Online Battles Upending Democracy in America. “Both are terms of service violations.”

When Forbes inquired about the account, Meta removed it for violating its policies. And though Meta did not say who was responsible for Kathleen’s persona, where it originated from or what their motives may have been, Barrett said “most telling is that the account began salting in anti-Ukraine content and then switched over to the Gaza/Israel conflict.” A number of Kathleen’s “friends” sometimes appeared to be sharing or reposting the same divisive content around the same time. But Meta said that “for now” it has not seen evidence of her account being part of a larger, coordinated network.

Online chaos spills on campus.

College students across the U.S. have been vocal about what’s unfolding in Israel and Gaza.

At Harvard, shortly after the conflict began, a letter from a coalition of student groups blaming Israel for the Hamas atrocities prompted backlash from some of the school’s most prominent alums, who’ve pledged not to hire people who signed onto the missive. At Penn, where Jewish students have been assaulted, buildings have been vandalized and large anti-Israel protests have taken place, megadonors from Apollo CEO Mark Rowan to former U.S. Ambassador Jon Huntsman have pledged to close their wallets to the university; many more have called for its leaders to resign over their handling of antisemitism on campus. Similar tensions are playing out at Stanford, UC Berkeley, NYU and beyond as students and locals protest the actions of the Israeli government and military, the growing humanitarian crisis in Gaza and the rising civilian death toll there. The Hamas-run Gaza Health Ministry says some 10,500 Palestinians have been killed since Israeli air strikes began in October.

But some of the organizing across higher education has boiled over into antisemitic and islamophobic hate speech and incitement to violence against Jews and Muslims on campus. The Anti-Defamation League and the Council on American Islamic Relationshave reported surges in hate crimes, threats or harassment against both groups. FBI Director Christopher Wray had a similar message in Senate testimony last week, warning lawmakers about domestic violent extremism targeting Jewish and Muslim communities across the country.

For example, anonymous antisemitic and islamophobic posts that surfaced recently on a Cornell discussion forum on Greekrank (which is not affiliated with the university) threw the campus into chaos. The viral posts included violent hate speech and racism against Jewish and Muslim students, as well as threats to kill or commit other illegal acts against them.

Some took to Greekrank to complain that anonymous commenters were “fueling hatred on our campus” and criticized the website for allowing anyone, including people who may not be associated with Cornell, to broadcast harmful messages. “Any idiot can post whatever they want here … Greekrank needs to add user verification, like, yesterday,” one person said. Another noted that “this site is toxic and the anonymity makes everything worse.” When someone else lamented that “there are no safeguards to prevent threats or hate speech” in this wide-open, easily accessible forum, they were met with more hate speech and a reply declaring: “Free speech is free speech. Go suk ur moms c0ck.”

Greekrank said in a statement that “we unequivocally condemn any form of hate speech and have taken swift action to remove the offensive content as soon as we were made aware of it.” It also emphasized that “we have been working closely with law enforcement to provide any information that can aid in their investigation.” It added that Greekrank is taking steps to “review and strengthen our platform’s moderation processes” and that it is “dedicated to preventing the recurrence of such unacceptable incidents.”

Last week, following an FBI investigation, the Cornell junior charged with posting some of the threats made his first appearance before a federal court in upstate New York. Shortly after, he’d already become the subject of several new threads on Greekrank. One was quick to recognize that while the 21-year-old student had allegedly posted some of the threats, others targeting Cornell had come from individuals who are still unknown.

“Yeah, he posted at least some of them,” one Greekrank post said. “Play stupid games, win stupid prizes. I can’t believe someone is grinding a Cornell engineering degree just to ruin it over being an insufferable troll.”

November 2023, CICO writer Staff Reporter Alexandra S.Levine

European regulators dealt a blow to TikTok over its handling of children’s data, the largest fine the company has faced to date.

TikTok’s lead regulator in the European Union is slapping the company with a €345 million fine for violating Europe’s landmark privacy law, the General Data Protection Regulation.

The nearly $370 million penalty announced today by the Irish Data Protection Commission is related to TikTok’s handling of sensitive data from children, ages 13 to 17, who’ve used the app—as well as from kids under 13 whose personal data TikTok has processed as part of determining whether they were old enough to be on the platform. (Users must be at least 13 to be on TikTok). The privacy watchdog, which opened the investigation in 2021, looked in particular at TikTok’s public-by-default settings and “Family Pairing” tool, as well as its age verification process for individuals signing up for an account. It also scrutinized whether TikTok had been adequately transparent with young users about their privacy settings. The body found that TikTok violated several parts of GDPR in 2020, including articles pertaining to the processing of young users’ data and to so-called “dark patterns,” design decisions that deceive or manipulate users into taking certain actions in an app. In addition to the hefty fines in the hundreds of millions, the commission is requiring TikTok to make its data processing compliant by the end of the year.

This all but concludes one of two major investigations that the regulator in Ireland, home to TikTok’s European headquarters, has launched into the company and whether it has complied with GDPR. The other probe is examining whether TikTok—owned by Beijing-based parent ByteDance—has unlawfully transferred European users’ personal data from the EU to China, and whether it was sufficiently transparent with users about how it was handling their information. (The Commission recently told Forbes it expects a public update on that inquiry around now).

This is TikTok’s largest ding from regulators to date, but it’s not the first time the social media giant has been punished for children’s privacy and safety missteps; earlier this year, Britain’s data watchdog issued TikTok a €12.7 million fine (almost $16 million) for breaking British data protection laws in its processing of kids’ information. In 2021, Dutch authorities issued a €750,000 fine (almost $1 million) for similar violations. And back in 2019, the Federal Trade Commission reached a $5.7 million settlement with TikTok (then Musical.ly) along the same lines. (Still, ByteDance posted $80 billion in revenue in 2022).

“TikTok is a platform for users aged 13 and over,” a spokesperson said in response to the recent U.K.-issued fine, which the company disagreed with. “We invest heavily to help keep under-13s off the platform and our 40,000-strong safety team works around the clock to help keep the platform safe for our community.” Weeks before that fine was handed down, TikTok also launched Project Clover—a counterpart to Project Texas in the U.S.—in an effort to better protect European TikTok users and their data and address concerns about access to that information in China.

In the first quarter of 2023, TikTok removed nearly 17 million accounts thought to be younger than 13, and 91 million videos that broke its rules, according to its most recent enforcement report. More than a quarter of those posts were pulled down for policy violations related to minor safety.

TikTok did not immediately respond to a request for comment.

September 2023, CICO writer Staff Reporter Alexandra S. Levine

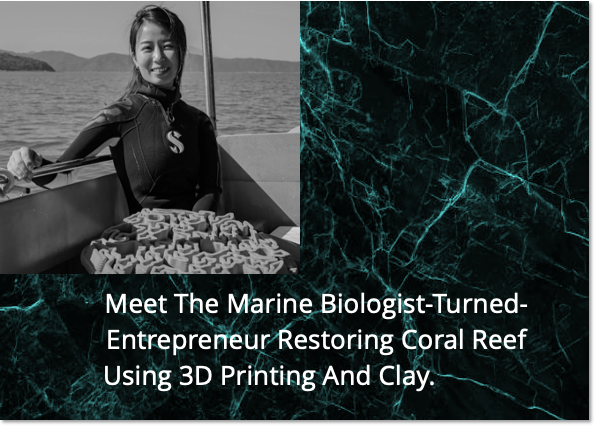

Innovation and sustainability: coral reefs.

Vriko Yu launched a startup on the back of her Ph.D. studies in biological sciences. Now she’s the CEO of Archireef, a climate tech venture that’s working to restore fragile marine ecosystems by using 3D printing technology and some good old-fashioned terracotta.

Coral reefs, the delicate breeding grounds for marine life, take years to fully form. That’s why Vriko Yu was deeply alarmed when, in 2014, she saw a coral reef community in Hong Kong die in just two months. “That was shocking,” says Yu, a 30-year-old doctoral student in biological sciences at the University of Hong Kong. “I’ve always known about climate change, but I did not know that it is happening at a pace where I can witness [the death of coral reefs] in such a short period of time.” Working alongside David Baker, a marine biology professor, and other researchers at the University of Hong Kong, they tried a variety of different ways to restore the fragile marine ecosystem, such as planting coral fragments onto metal grids and concrete blocks. Yet, they found the baby corals would often become detached and die. As frustrations mounted, the team finally came up with a solution: tiles made out of terracotta using 3D printers with carefully crafted designs that incorporate folds and crevices, enabling coral fragments to become attached to the seabed so that they can survive and grow. Yu says the coral seeded to their terracotta tiles have been able to achieve a survival rate of up to 98%.

With their prototypes in hand and driven by the urgent need for funding to scale up their operation, Yu and Baker decided to spin off a startup from the University of Hong Kong. The pair cofounded Archireef in 2020 as a climate solutions provider. With Yu serving as the startup’s chief executive, Archireef, which made the Forbes Asia 100 to Watch list last year, is working to rebuild the marine ecosystems degraded by climate change to achieve carbon neutrality. “When it comes to climate tech, most people are focusing on reducing carbon emission,” says Yu in an interview from Archireef’s office in Hong Kong Science Park. “However, I would also like to emphasize that while tackling the root cause is critical and essential, it is also as important to do active restoration because nature recovery by itself is very slow and it’s not going to catch up with climate change.”

Coral reefs only cover 0.2% of the seafloor, but provide outsized benefits to the environment. About a quarter of the ocean’s fish depend on coral reefs for their food and shelter at some point in their life cycles, helping to provide a food source and livelihood for hundreds of millions of people worldwide. It’s estimated that coral reefs support $2.7 trillion a year in goods and services, including $36 billion in tourism.

However, coral reefs are extremely sensitive to warming waters. Corals can lose the algae that provides them with food when sea temperatures are abnormally high—a process known as bleaching because it’s the algae that gives them their bright colors. According to a report released by the Global Coral Reef Monitoring Network last year, the world had already lost 14% of its coral reefs between 2009 and 2018. Another report published in 2018 by the Intergovernmental Panel on Climate Change, the global scientific authority on climate change, shows that “virtually all” (more than 99%) of the world’s coral reefs would be lost if temperatures rise by 2 degrees Celsius.

Archireef operates on a subscription model, where corporate clients and government agencies pay regular fees to cover the maintenance and monitoring costs of its coral restoration projects for at least three years. In return, Archireef provides them with a report detailing the ecological impact of their investment that they can use for their ESG reports and marketing materials.

It’s estimated that coral reefs support $2.7 trillion a year in goods and services, including $36 billion in tourism.

Yu says Archireef is already profitable and its clients include Hong Kong companies like jewelry chain Chow Sang Sang and real estate company Sino Group, which is run by Singapore billionaire Robert Ng.

“We are very sustainability-minded,” says Melanie Kwok, assistant general manager of sustainability at Sino Group, in an interview at the company’s The Fullerton Ocean Park Hotel Hong Kong. “We have played a role to actually protect the ocean.”

The Fullerton Ocean Park Hotel is one of the six hotel properties owned by Sino Land, the group’s property company listed in Hong Kong. Opened in July 2022, all of its 425 rooms and suites have sea views. “As you can see, all our rooms are facing the ocean,” says Kwok. “That’s why we have a role to play. We have a role to educate our customers and stakeholders of the importance of preserving the ocean so that we can all see and view this beautiful ocean together.”

Archireef’s terracotta tiles have so far been scattered across roughly 100 square meters of Hong Kong’s waters. After laying the foundations for growth in the city, Yu now has her sights on overseas expansion—and she’s starting with Abu Dhabi, the oil-rich capital of the United Arab Emirates, which has been trying to diversify its economy before the fossil-fuel era ends.

The startup said it’s working with sovereign wealth fund ADQ to restore an area of 40 square meters of waters near the United Arab Emirates capital, which will become the nurturing ground of around 1,200 coral fragments. Last year, Archireef also established a 400 square-meter facility in Abu Dhabi, after receiving an undisclosed amount of funding from ADQ. The facility will certainly boost the company’s international expansion by allowing it to mass produce its reef tiles.

The Abu Dhabi government announced in 2021 that the United Arab Emirates aims to achieve net-zero carbon emissions by 2050, making the emirate the first in the region to set such a target. It was Abu Dhabi’s commitment to sustainability that convinced Yu to set up Archireef’s first overseas operations in the United Arab Emirates, which is hosting this year’s COP28 climate summit.

“When we were thinking about our expansion outside of Hong Kong, the United Arab Emirates really came up to be one of the strongest markets, not only because of the financial performance, but also the push for sustainability,” she says.

Archireef’s ambition doesn’t limit to just restoring coral reefs. The startup is busy expanding its product line so that it can also help regrow species that create the natural habitats for other organisms. These species include mangroves and oysters, says Yu.

Meanwhile, Yu is in a hurry to expand Archireef and deploy its reef tiles around the world, including in the Atlantic, Indian and Pacific oceans. She’s racing against the clock to safeguard coral reefs. “We have already lost 50% of the world’s coral reefs since 1950. And if nothing changes, we will lose up to 90% by 2050,” she says. “So if I can deliver one message here today, it’s: Please take the time to grab our last opportunity to reverse climate damage.”

July 2023, CICO writer Staff Reporter Zinnia Lee

Social Media Update.

ver the past several years, thousands of TikTok creators and businesses around the world have given the company sensitive financial information—including their social security numbers and tax IDs—so that they can be paid by the platform.

But unbeknownst to many of them, TikTok has stored that personal financial information on servers in China that are accessible by employees there, Forbes has learned.

TikTok uses various internal tools and databases from its Beijing-based parent ByteDance to manage payments to creators who earn money through the app, including many of its biggest stars in the United States and Europe. The same tools are used to pay outside vendors and small businesses working with TikTok. But a trove of records obtained by Forbes from multiple sources across different parts of the company reveals that highly sensitive financial and personal information about those prized users and third parties has been stored in China. The discovery also raises questions about whether employees who are not authorized to access that data have been able to. It draws on internal communications, audio recordings, videos, screenshots, documents marked “Privileged and Confidential,” and several people familiar with the matter.

In testimony before Congress earlier this year, TikTok CEO Shou Zi Chew claimed U.S. user data has been stored on physical servers outside China. “American data has always been stored in Virginia and Singapore in the past, and access of this is on an as-required basis by our engineers globally,” he said under oath at a House hearing in March.

TikTok spokesperson Alex Haurek said in a statement that “we remain confident in the accuracy of Shou’s testimony.” ByteDance did not respond to a detailed request for comment. At publication time, neither company had answered basic questions about whether sensitive tax information of U.S. citizens is stored and accessible in China.

Over the last year, TikTok has been touting its plans to cordon off Americans’ data from China in a $1.5 billion undertaking called Project Texas. That initiative has been central to negotiations with the Biden administration on a deal that would allow the wildly popular app to continue operating in the U.S., despite longstanding national security concerns about its Chinese ownership and the potential for the platform to be used to surveil or influence the 150 million Americans using it. But since those talks hit a snag late last year, with both FBI Director Christopher Wray and Treasury Secretary Janet Yellen speaking out about national security issues with the app, the Biden administration (through the Committee on Foreign Investment in the U.S.) has demanded that TikTok split from its Chinese parent company or face a possible ban.

“There’s ongoing litigation over TikTok that is not yet resolved,” Yellen, whose department leads CFIUS, said at a hearing in March. And many in Congress have cast doubt on Project Texas altogether: “I don’t believe that it is technically possible to accomplish what TikTok says it will accomplish through Project Texas,” California Republican Jay Obernolte told the TikTok CEO at the March hearing. “There are too many backdoors.”

“Even if TikTok was not a subsidiary of a Chinese company, this would be pretty alarming IT security malpractice.”

Identity theft using stolen social security numbers is not uncommon in the U.S., and the Chinese government has been accused of stealing personal financial information from Americans before. One expert told Forbes this is precisely why TikTok’s mishandling of such information is troubling.

“Even if TikTok was not a subsidiary of a Chinese company, this would be pretty alarming IT security malpractice,” Bryan Cunningham, a former national security lawyer for the White House and CIA, told Forbes. He described tax records as some of the most sensitive data there is.

“It could be just bad IT practice, it could be they felt like they had a legitimate business need,” Cunningham said of TikTok. “But whatever the nuance of that turns out to be… if you store information in the PRC, you better assume that the intelligence services can have it if they want it. They may not target you, but boy, on the face of it, it’s highly questionable.” TikTok and ByteDance did not respond to questions about how many people at the companies can access creators’ financial information, where those employees are located and whether there has been unauthorized access to this data. They also did not respond to queries about how long TikTok users and vendors’ payment data had been stored in China and whether it still is today.

Raising regulatory alarms on both sides of the Atlantic.

TikTok or ByteDance employees in China having access to American users and businesses’ sensitive financial records is potentially problematic for geopolitical reasons, particularly against the backdrop of intense regulatory scrutiny in the U.S.

Though there is no national privacy law in the U.S. to protect against the mishandling or misuse of personally identifiable information, one top contender introduced last Congress would require companies to clearly disclose in their privacy policies whether data they collect “is transferred to, processed in, stored in, or otherwise accessible to the People’s Republic of China” and other adversaries. And though a past Federal Trade Commission settlement with TikTok (then Musical.ly) dealt with a markedly separate set of issues—children’s privacy violations—the agency could take that order into consideration when evaluating the company’s conduct today.

Jessica Rich, former director of the FTC’s Bureau of Consumer Protection, said in a case like this, the agency would likely consider whether the company had made false or deceptive statements about how it handles users’ information—in a privacy policy, for example—or if the handling of that information had created a real risk of harm. She would not comment specifically on TikTok and ByteDance.

TikTok’s policies suggest that it takes appropriate steps to protect its users’ data. Creators who join TikTok’s Creator Fund agree to “all” TikTok policies, including privacy terms stating that “certain entities within our corporate group… are given limited remote access to information we collect” if it’s necessary for the platform’s operations. They also emphasize that “we use reasonable measures to help protect information from… unauthorized access.” (It does say TikTok may transmit user data to servers outside the U.S. for storage or processing, and that no data storage or transmission is guaranteed to be secure.) Rich, the former federal regulator, said that if any company claims to be locking down access to information but then making it available to employees around the world who do not need it, the FTC could see that as a deceptive statement and grounds for a potential data security complaint. She also said that the agency generally views financial information and social security numbers as more sensitive than email addresses or phone numbers, and that it may scrutinize those data-sharing cases more aggressively.

“I would like everything to stay in the U.S.—like, I wouldn’t see why it would ever need to be stored on a China database.”

TikTok’s storage of European creators’ bank information in China could also be problematic under Europe’s privacy law, the General Data Protection Regulation.

Even as TikTok launched Project Clover—a Project Texas counterpart across the Atlantic—to safeguard the data of its European users, the Irish Data Protection Commission (TikTok’s lead regulator in the European Union) is already conducting two investigations into whether the company has complied with GDPR. One of those probes is looking specifically at whether TikTok has unlawfully transferred European users’ personal data from the EU to China, and whether it was adequately transparent with users about how it was handling their information. Gabriela Zanfir-Fortuna, vice president for global privacy at the Future of Privacy Forum, said ByteDance tools storing European creators’ data on servers in China could be problematic for that reason.

“This is the sort of thing that would confirm there are transfers [of personal data] to China happening, so I’m sure they would be interested in knowing this,” she said of Ireland’s privacy watchdog. (Just last week, the body issued a record $1.3 billion fine to Facebook parent Meta, one of TikTok’s biggest rivals, over its own data transfer issues.) GDPR also requires companies to restrict access to sensitive user data on a need-to-know basis, Zanfir-Fortuna added, raising questions about how broad access to these payment tools has been and whether it was necessary.

The Commission would not comment on its ongoing inquiry into TikTok except to say it expects a public update after this summer. TikTok’s policies for Europe say “certain entities in our Corporate Group, located outside your country of residence (see here), are given limited remote access to this information” and that this access is “secure and only granted where necessary under strict security controls.” The link included (“here”) lands on a 404 error page.

June 2023, CICO writer Staff Reporter Alexandra S. Levine

ChatGPT and freelancers

Shea has not posted a job on Upwork since she discovered ChatGPT (though she still has five freelancers working for her). After it was released in November 2022, ChatGPT amassed more than 100 million users, sparked an AI arms race at companies like Microsoft, Google and Amazon and has given rise to a flurry of AI startups. And for small businesses looking to trim costs, the free tool can automate swaths of their operations, providing a cheaper alternative to freelance workers. Built on recent advances in generative AI, ChatGPT and its image-based sibling DALL-E 2 can carry out work that spans most of the freelancing spectrum, from writing articles and compiling research to designing graphics, coding and decrypting financial documents.